Commodities Trading

Invest in the most active global markets commodities including Gold, Silver, and Crude Oil with the award winning platform.

Why Trade Commodities with Just2Trade

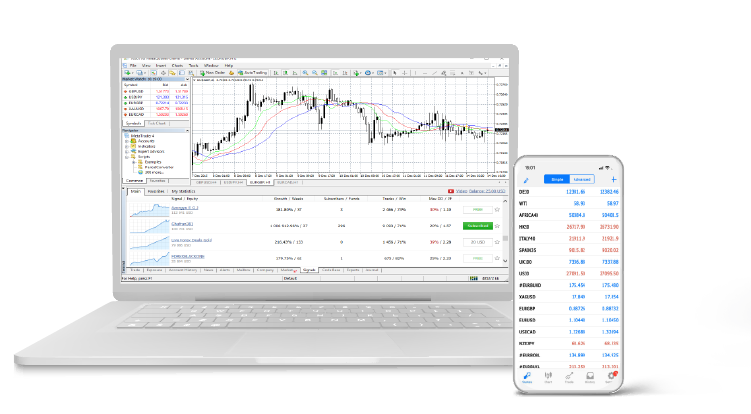

Trading Platforms

Trade Commodities on MT4 across desktop and mobile or MT5 across webtrader, desktop and mobile, all on our powerful and secure technology infrastructure.

MetaTrader 4 at Just2Trade

- Leverage Up to 1:500

- Minimum lot size of 0.01

- 70+ Forex Pairs

- 75+ CFDs

- 10+ Commodities and metals

- No trading restrictions

- Strict CySEC regulation

- 20+ deposit and withdrawal methods

MetaTrader 5 at Just2Trade

- Credit Leverage for all products

- Strict CySEC regulation

- More than 128,000+ Trading Products such as:

- 70+ Forex Pairs

- 30,000+ Stocks from all over the world

- 5,000+ Global Futures

- 90,000+ Options

What is Commodity Trading?

Commodity trading forms the basis of the global trade ecosystem. For many traders, commodity trading is a preferred way to protect funds and reduce trading portfolios risk. With the advent of online commodity trading, our traders gained access to global commodities markets with relatively modest amounts of capital.

Commodities trading is ideal for traders to analyse supply and demand across the world, and how these affect commodities prices due to current economic and political events. Commodities have become a popular means of inflation hedging and portfolio diversification.

Just2Trade offers traders the opportunity to trade commodity markets on a range of Gold, Silver, and Crude Oil with low margin requirements and hedging strategies to manage our traders price exposure.

Get the confidence of trading with an awarded multi-asset broker. Start trading commodities and get your benefits with Just2Trade now !

What Drives The Price of Gold?

People want to invest or buy gold to protect themselves from volatility and uncertainty. Underlining gold’s attraction as an asset for good times and bad, most investors would buy gold whether the domestic economy was growing or in recession. The currency goes down when inflation arises and therefore people tend to hold money in the form of gold. Therefore, when inflation remains high over a longer period, gold becomes a tool to hedge against inflationary conditions. This pushes gold prices higher in the inflationary period.

The amount of Gold held by Central Banks around the world impacts the price of this precious metal. The more the Central Banks buy and store away the more the price rises

Under normal circumstances, gold and dollar share an inverse relationship. Since international gold is dollar denominated, any weakness in the dollar pushes up gold prices and vice versa. The inverse relationship is because firstly, a falling dollar increases the value of currencies of other countries. This increases the demand for commodities, especially gold.

Factors Affecting Crude Oil prices

People want to invest or buy gold to protect themselves from volatility and uncertainty. Underlining gold’s attraction as an asset for good times and bad, most investors would buy gold whether the domestic economy was growing or in recession. The currency goes down when inflation arises and therefore people tend to hold money in the form of gold. Therefore, when inflation remains high over a longer period, gold becomes a tool to hedge against inflationary conditions. This pushes gold prices higher in the inflationary period.

The amount of Gold held by Central Banks around the world impacts the price of this precious metal. The more the Central Banks buy and store away the more the price rises

Under normal circumstances, gold and dollar share an inverse relationship. Since international gold is dollar denominated, any weakness in the dollar pushes up gold prices and vice versa. The inverse relationship is because firstly, a falling dollar increases the value of currencies of other countries. This increases the demand for commodities, especially gold.Crude oil prices change quickly in response to news cycles, policy changes, and fluctuations in the world’s markets. In February and March of 2020, crude prices accelerated their decline in reaction to the coronavirus pandemic and an expected sharp drop in demand for oil.

Crude oil prices fluctuates depending on supply and demand situation, future supply and reserves as well as Political events and crises.

The supply crude oil is also determined by external factors, which might include weather patterns, exploration and production (E&P) costs, investments, and innovations

Strong economic growth and industrial production tend to boost the demand for oil. Other important factors that affect demand for oil include transportation (both commercial and personal), population growth, and seasonal changes.

Commodities CFD traders determine the price of oil by bidding on futures contracts in the commodities market. Oil prices can change depending on what happened in the market that day. Traders consider three main factors when creating bids that determine oil prices, which are Current supply, Future supply and Demand.

BENEFITS OF COMMODITIES TRADING

High leverage

Portfolio Diversification

Liquidity

Hedging against Inflation

Long-Short Positioning

Trading on margin: Just2Trade offers you with the opportunity to trade commodity CFDs and other top-traded commodities with a limited amount of funds in your account.

Trading the difference: By trading commodity CFDs, you don’t need to buy the underlying asset. You only speculate on the rise or fall of the particular commodity. As a CFD trader, you can set stop and limit losses and apply trading scenarios that align with your trading objectives.

All-round trading analysis: We offer MT4 & MT5 platform that allows traders to shape their own market analysis and make forecasts with technical indicators. The platform provides live market updates and chart formats to desktop, iOS and Android.

Focus on safety: Just2Trade emphasized on client’s capital safety. We are EU authorized and licensed by Cyprus Securities and Exchange Commission (CySEC) under license number 281/15. We complies with all regulations and ensures that our clients’ funds and data security are our top priority. We allow traders to withdraw money and keeps our traders’ funds in segregated bank accounts.

Start Trading in 3 Steps:

APPLY

Complete the simple application form below.

VERIFY

Upload documents to verify your account.

FUND & TRADE

Fund account with as little as $100 and start trading the global markets.

Funding Methods

© 2021 Just2Trade Online Ltd Just2Trade Online Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission in accordance with license No.281/15 issued on 25/09/2015. Registration Number: HE 341520

This website is designed for clients' purpose from Asia. Clients from Europe and USA need to open an account via https://just2trade.online

Address: Just2Trade Online Ltd 10 Chrysanthou Mylona, MAGNUM HOUSE 3030 Limassol, Cyprus

Logo

and

and

belong to Just2Trade Online Ltd

belong to Just2Trade Online Ltd

Risk warning: Trading on financial markets carries risks. The value of the investments can both increase and decrease and the investors may lose all their investment capital. In the case of a leveraged product, the loss may be more than the initial capital invested. Detailed information on risks associated with trading on financial markets can be found in full risk disclosure. Investment risks related to cryptocurrencies can be found in the following disclosure

Disclaimer: All promotions, materials and information of this website may have applied conditions. Please contact the Company for further details